Ever headed to the shops for toothpaste and walked out with $187 of “essential” life upgrades? Yep. Welcome to the dopamine-fuelled world of ADHD impulse spending.

For us NeuroSpicies, shopping can turn into a thrill ride—part retail therapy, part treasure hunt, part “what just happened?” It’s not about being careless or bad with money. It’s about brain wiring. And guess what? You’re not alone, and you’re not broken.

Why Impulse Spending Happens with ADHD

1. Dopamine, Darling!

ADHD brains run on low dopamine. That “oooh shiny!” moment when you see something you must have? That’s your brain going, “YES! We found dopamine!” But the hit is short-lived—like a sugar high followed by regret and an overdraft.

2. Executive Dysfunction = Budget, Schmuget

Impulse control, planning, prioritising—these are all executive functions. When they’re not firing on all cylinders, managing money becomes less like spreadsheets and more like emotional Whac-A-Mole.

3. Emotion Regulation Woes

Bad day? Lonely? Overwhelmed? Shopping gives you control when everything else feels like chaos. It’s not just about stuff—it’s about soothing. But it’s temporary. The credit card bill? Not so much.

4. Delayed Gratification is NOT Our Superpower

That dress might be cheaper next week… but the rush of having it right now wins. Every time.

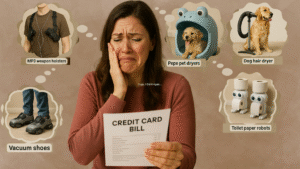

What It Looks Like in Real Life

Let me tell you about Jo. She’s a smart, capable woman with ADHD, running her own biz. But when stress hits, she hits “add to cart.” After a tough client call, she once bought a weighted blanket, a LED moon lamp, three planners, and a book on minimalism. #IronicMuch

She didn’t need more things—she needed relief.

Or Sam, who uses Amazon as a dopamine vending machine. “I know all my delivery drivers by name,” he joked. Behind the humour? Financial stress and shame spirals.

A Few NeuroSpicy Steps to Break the Cycle

1. Pause the Pattern

Notice your urge. Ask, “What am I really needing right now?” Connection? Rest? Validation?

2. Make a ‘Buy Later’ List

Use Notes or an app like Shiny Object Delay. If you still want it in 48 hours, revisit it. Often, the urge fades.

3. Set a Spicy Spending Limit

Give yourself a fun fund. $30 a month? Great. Guilt-free dopamine, with boundaries.

4. Body Double Your Budget

Find a money buddy. Just like co-working, budgeting together—even over Zoom—can help you stay on track.

5. Use the Right Tools

Apps like Pocketbook, YNAB, or Snoop can help flag when spending goes off-track. You need tools that talk with your brain, not down to it.

Why It’s Harder for NeuroSpicy Brains

It’s not just a lack of discipline—it’s the way our brains process decisions, emotions, and rewards. The ADHD brain has a now/not now relationship with money. Planning for “later” requires cognitive effort we don’t always have to spare.

Add in a lifetime of feeling “bad with money” and it’s a recipe for shame. But you don’t need shame. You need strategy—and compassion.

Final Thought

Impulse spending isn’t a moral failing. It’s a signal. Your brain is seeking relief, connection, or excitement. Start listening with kindness.

You’re not bad with money—you’re wired differently. And with a few spicy tweaks, your finances can start to feel less like a warzone and more like a well-organised (and dopamine-safe) Command Centre.

Want to break free from the spending-shame cycle? Join our next Money Flow Challenge inside the NeuroSpicy Membership, where we tame the chaos with humour, real talk, and ADHD-friendly strategies that actually work.

#MoneyMastery #NeuroSpicyFinance #ImpulseSpendingADHD